gsa per diem rates

First last day of travel - amount received on the first and last day of travel and equals 75 of total MIE. For tax purposes then employees will only need to account for the.

|

| Per Diem Rates Current Historical Trends By Chelsey Leffet |

Figure that every time you fly for 50 less that is 750 per month or 9000 per year fewer bucks for you if you average 15 flight days per month.

. If your company decides to set its own per diem rates be aware that the GSA rates will apply for the purposes of taxation. Links to foreign rates established by the State Department and non-foreign. If for instance your companys 2017 per diem rate for New York City is 500day that figure will be 199 above the federal rate for NYC in October. The standard total per diem rate is 155 96 lodging 59 M.

You may use the dropdown box below to select a country. Note that this page pro-rates incidentals on travel days. Some agencies may allow up to 150 of the base lodging rate with prior approval and is included for that reason. Breakfast lunch dinner incidentals - Separate amounts for meals and incidentals.

Per Diem Rates are the allowed reimbursement rates for hotel stays and meals for federal travelers. MIE Total Breakfast Lunch Dinner Incidentals. Still if you are not asking enough for yourself for contract work you could be losing out. Besides making bookkeeping and expense documentation easier for businesses per diem rates and the GSA have other benefits worth considering.

Many businesses and other organizations adopt these rates as well. Standard M. Find current rates in the continental United States CONUS Rates by searching below with city and state or ZIP code or by clicking on the map or use the new per diem tool to calculate trip allowances. Entering the first letter of the country name will jump to that portion of the listing.

Standard Rate For all locations without specified rates 96. GSA Per Diem Primary Destination County Oct 2021 Nov 2021 Dec 2021 Jan 2022 Feb 2022 Mar 2022 Apr 2022 May 2022 Jun 2022 Jul 2022 Aug 2022 Sep 2022 Meals per day Breakfast. Dollars DSSR 925 Country. Clicking Go will display Per Diem data for all locations within the country selected.

Calculation of travel per diem rates within the Federal government is a shared responsibility of three organizations. Rates once a year or as necessary. I dont know about you but maybe it is time for you to give yourself a raise. GSA updates the Continental US.

Rates are set for each of the federal governments fiscal years October 1st to September 30th GSA is responsible for setting the rates in the continental United States. GSA establishes per diem rates for destinations within the continental United States CONUS. Foreign Per Diem Rates In US. Benefits of per diem rates GSA.

Sometimes meal amounts must be deducted from trip voucher. The lodging rate may change based on the season and excludes taxes and surcharges. Per diem ratesthe allowance for lodging excluding taxes meals and related incidental expensesare regularly reviewed and adjusted according to market conditions. Per Diem Rates Query.

View summary of changes. STANDARD CONUS RATE RESERVE COMPONENT ALABAMA ARKANSAS ARIZONA CALIFORNIA COLORADO CONNECTICUT DELAWARE DISTRICT OF COLUMBIA FLORIDA GEORGIA IDAHO ILLINOIS INDIANA IOWA KANSAS KENTUCKY. You may use the input field below to enter all or part of a post name. The General Services Administration GSA prescribes rates for the Continental US.

Normally the rates are updated at the start of the new fiscal year. Rates are set by fiscal year effective October 1 each year. Foreign Per Diem Rates by LocationDSSR 925.

| New Fy 2012 Per Diem Rates Now Available Gsa |

|

| San Diego S Government Per Diem Rate Recalculated To 139 For Fy14 Sdta Connect Blog |

|

| Irs Updates Per Diem Rates For 2020 2021 |

.png) |

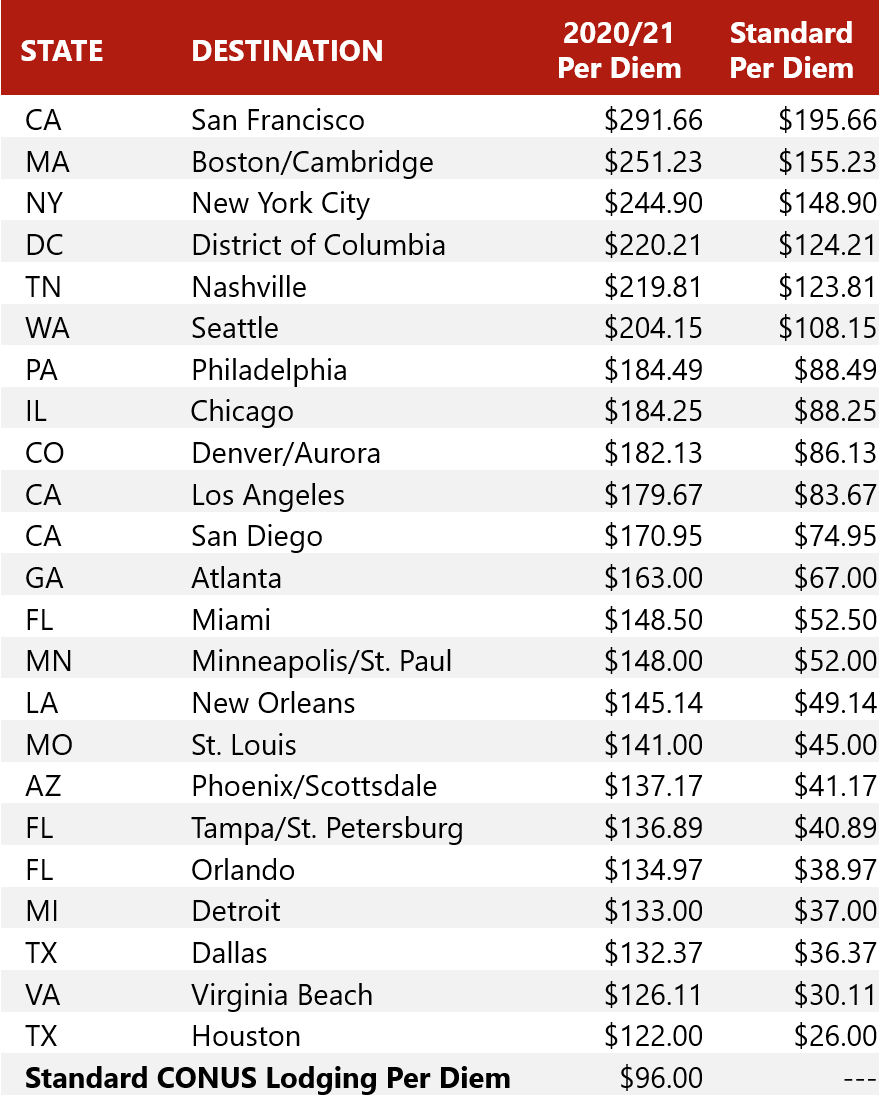

| Federal Per Diem Fiscal 2020 21 Historical Trends Hotel Online |

|

| Federal Per Diem Fiscal 2020 21 Historical Trends Hotel Online |

Posting Komentar untuk "gsa per diem rates"